The Asian Development Bank is one of the largest international investors in Papua New Guinea, mainly in infrastructure. One of its six Vice-Presidents, Diwakar Gupta—who is responsible for Private Sector and Cofinancing Operations—tells Business Advantage PNG the bank also has funds to invest in PNG’s private sector, under certain conditions.

The ADB’s Diwakar Gupta Credit: ABAC

Business Advantage PNG (BAPNG): The Pacific is changing; geopolitical interests have started to emerge and there is money available to the region that was not there previously. How does the Asian Development Bank (ADB) sit with that new paradigm?

Diwakar Gupta (DG): We are agnostic about the sources, where money comes from. But we are very particular about the processes of its deployment.

It should not go into a project which is not environmentally friendly, and it must meet all our guidelines. The bidding should be transparent, there should not be anything opaque or questionable about the way the contracts are ordered, and the use of funds should be ascertained through a mechanism which has been agreed upon.

As long as those three conditions are met, we are fine. It doesn’t matter where the money is coming from. Eventually, the giver and the taker have to determine that it’s good for both of them—we have no particular view on that.

BAPNG: What about risk? PNG has only a moderately healthy credit rating internationally. What can the ADB do to help?

DG: If it’s a non-sovereign project, credit risk is the number one risk that has to be assessed.

‘After infrastructure, the next biggest arm of our lending is financial institutions.’

The ADB’s role is to recognise that, although we are enablers first and profit-seekers later, we must still make money on our private sector operations. We cannot be cheaper than the market because then, by definition, we are crowding out capital that can easily flow in.

If we have a project that really is too risky for mainstream lenders, we can credit-enhance it to some extent by giving it subordinated debt, by taking a little higher risk. But we can’t make it fully bankable.

BAPNG: Have there been examples in other markets where the ADB has been able to leverage its experience to convert a state-owned entity into a successful private business? Do you think PNG could learn from some of those examples?

DG: We have several examples of SOEs that we have financed on a non-sovereign basis. Not necessarily that they became private; they continued to be state-owned. But they are competing in an open market and we are ensuring that the competition is not skewed by anything special that the government has given to them.

BAPNG: When it comes to investing in private businesses, is there a desire by the ADB to look for opportunities directly?

DG: Absolutely. After infrastructure, the next biggest arm of our lending is financial institutions.

We cannot go and give an SOE loan to X, Y or Z (other parties); we don’t have the wherewithal to be able to track it and administer it. So we use the secondary route of selecting a good financial institution, giving them a line of credit and giving them a design in monetary framework. We say: ‘We want this pool of money to be deployed in such-and-such fashion.’

‘We wouldn’t do a project because it’s already been mandated to a certain contractor, or country.’

On the infrastructure side, we have a lot of large private sector projects which are purely private.

BAPNG: In a developing country like PNG, there might be a great business opportunity but maybe the principals of the business coming to you might not have international exposure to develop their skills and experience. Can the ADB help a company become more successful?

DG: We give technical assistance all the time. For a financial institution, it could be about their platform, or about their marketing, or about an analytics engine to be put in to make them more efficient. On infrastructure, it could be environmental studies.

BAPNG: One of the key things about infrastructure is not just that the money is spent and the project is built, but that it is built to certain standards and that there is a good value for money from the investment. What does the ADB do to make sure that that the borrower gets the maximum value from their money?

DG: On the private sector side, we would be very robust about projections, forecasts, simulations. We have a risk management department which is completely independent. On the sovereign side, it is a relationship. As far as construction and quality is concerned, we track end-use, we track procurement, we have got a huge department doing only procurement. We wouldn’t do a project because it’s already been mandated to a certain contractor, or country.

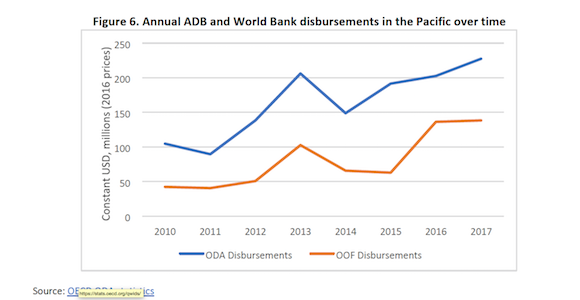

ADB and World Bank Official Development Assistance (ODA) and Other Official Flows (OOF) disbursements. Source: OECD, Australian National University

Speak Your Mind