Waiting times on foreign exchange orders have been falling substantially on central bank interventions and other factors, senior representatives of BSP Financial Group, Kina Bank and Westpac Papua New Guinea reveal to Business Advantage PNG.

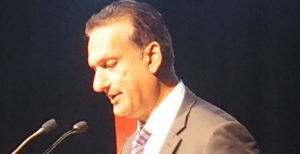

Bank of PNG Chairman David Toua addressing the 2024 PNG Investment Conference earlier this week. Credit: BAI

Waiting times on essential foreign exchange orders have fallen substantially in recent months, senior representatives of Papua New Guinea’s three major retail banks tell Business Advantage PNG.

BSP Financial Group has seen waiting times on essential orders fall to two-to-four weeks from a peak of six-to-eight weeks, according to Rohan George, Group General Manager Treasury and Markets.

At Kina Bank, the largest orders are now being filled in six-to-eight weeks – around half the amount of time they were taking at the beginning of 2024, Deepak Gupta, EGM Wealth Management & Corporate Advisory tells Business Advantage PNG.

Patrick Wright, Treasurer at Westpac PNG, has seen a similar trend too, with priority orders now being filled within one and four weeks, instead of the previous four-to-six weeks.

With thanks to BPNG, increased forex inflows

All three bankers give the same two reasons for the improved waiting times: increased interventions in the forex market by the Bank of Papua New Guinea (BPNG), and increased forex inflows from PNG’s exporters.

Kina’s Deepak Gupta. Credit: BAI

Gupta notes that the central bank has been making “more regular FX market interventions” as required.

“That is helping to ease pressure in the market and ensure the backlog is contained,” he tells Business Advantage PNG.

Wright similarly notes a shift in how the central bank intervenes, from once per month to now around once per week.

“They have brought more transparency, because the banks have been able to submit orders based only on the amount of their essential orders, and not on the total size of orders, so [excluding] all the service orders and things like that. And it has also meant there has been more regular and consistent management of the order book, which means we can manage it more effectively.”

The central bank has also provided clarity on which orders the banks should prioritise, according to Wright.

“This allows us to improve wait times for those orders which are in the national interest: providing goods and services to keep the country running, especially on the back of [the] January 10 [riots]. That’s been a great improvement.”

George says central bank interventions “are definitely supporting the market.”

“[Moreover], there have been good flows [of forex] from Ok Tedi, good flows from New Porgera, and also the palm oil industry has provided good support for the market,” he says.

“I think the situation is quite manageable. People talk about difficulties with foreign exchange, but if you can wait a couple of weeks – up to four weeks – then there are no major problems.”

Outstanding orders fluctuate

George and Gupta both point out that peaks and troughs in forex supply and demand are to be expected.

“When you talk about the size of outstanding market orders, it depends at that moment whether it’s before or after forex interventions or a large export flow. That can dramatically change outstanding orders,” George says.

“Outstanding orders might be K1.6 billion for the market one day, and then the next – with a few good flows and intervention – it might be K1 billion.”

According to Gupta, there “remains a question of latent demand, particularly to do with capital outflows related to dividend repatriations and offshore investment needs. And that needs to be understood better when judging total system demand.”

George makes a similar observation: “The big unknown with outstanding market orders is how much is behind that which hasn’t been placed on order boards – [such as] dividends from previous years by multinational corporations, and what the volume of trapped cash is behind it.”

He summarises: “With outstanding FX market orders of K1.2 billion, there might be a billion or two more behind that which just hasn’t been declared or put on the FX order boards. So, as outstanding orders fall, there are always new orders that come out to replace them, so it seems like a bit of a never-ending journey.”

Central bank to continue forex interventions

BPNG Chairman David Toua confirmed in his speech to the 2024 Business Advantage PNG Investment Conference that the central bank will continue its forex interventions.

“As it is, the bank continues to intervene in the foreign exchange market to alleviate demand pressures, and will continue to act with caution, with a careful eye on the benefits and costs of our actions, while outstanding orders remain at a monthly average of around K1.2 billion,” Toua told the conference.

Sohrab Rafiq, International Monetary Fund Resident Representative in PNG, also spoke about the benefits of the PNG’s forex interventions and new ‘crawl-like’ exchange rate policy in his speech to the conference.

As Rafiq noted in a previous interview with Business Advantage PNG, the IMF has been providing financing and technical support to help the Papua New Guinea central bank achieve its aims.

“The key point [under the crawl-like mechanism] is that the exchange rate will be more reflective of market conditions… [and] you won’t have these big sudden jumps in the exchange rate like you would under a fully floating exchange rate system,” Rafiq told the conference.

“The advantage of this system is that by having an exchange rate that’s more reflective of its market conditions, it’ll help protect the country’s foreign exchange reserves.”

Looking back on the previous policy, Rafiq said an overvalued kina is “not just bad economics, it’s also unfair from an equity perspective as well.”

“If you can make the country attractive enough and if you can reward investors sufficiently enough through the pricing mechanism and the exchange rate, then hopefully that will generate investment that will push up GDP growth, that will encourage job growth, push up household incomes and essentially deal with the cost-of-living crisis.”

Speak Your Mind