Businesses in Papua New Guinea must have strategies to manage the current shortage of foreign exchange, says Stephen Massa, Port Moresby Managing Partner of law firm, Dentons. He looks at some approaches but warns that businesses must pay attention to their legal obligations.

Dentons’ Stephen Massa Source: Dentons

The pressure of limited foreign currency supply in PNG is currently part and parcel of doing business in the country. It affects any business that needs to pay offshore suppliers of goods or services, or repay offshore loans.

It also affects foreign-owned businesses wanting to remit profits.

Despite these pressures, it is imperative that businesses avoid unintentionally breaching PNG’s foreign exchange controls.

Businesses must keep in mind that all offshore debts must be settled via an actual outflow of money through an authorised dealer and not simply via an off-setting, notional or account entry arrangement.

Controls

The Bank of Papua New Guinea, PNG’s central bank, has tightened control around foreign currency movement and accounts.

For example, it has placed a stay on the opening of any new onshore foreign currency accounts. It has also required entities with existing onshore foreign currency accounts to reapply to the bank to keep those accounts open as foreign currency accounts.

‘Businesses that have received the bank’s approval to maintain their onshore foreign currency account must comply with the bank’s conditions for using this account.’

If the bank is not satisfied with an applicant’s need to maintain an onshore foreign currency account, deposits in that account are converted into PNG kina (PGK).

Compliance

Businesses that have received the bank’s approval to maintain their onshore foreign currency account must comply with the bank’s conditions for using this account.

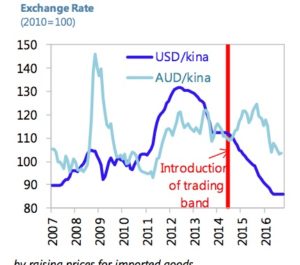

Foreign exchange rates for the Kina. Source: IMF

In general terms, this means that the account is usually limited to making or receiving foreign currency payments under core commercial contracts necessary for that business to operate effectively in PNG.

Many businesses may be motivated to look for creative or innovative ‘solutions’ to the issue of limited foreign currency supply in PNG. For example:

- A business in need of foreign currency to pay an offshore supplier might propose to transfer an agreed amount of PGK to a business that has foreign currency and can pay the offshore supplier on their behalf; or

- A business with an onshore foreign currency deposit might consider making a foreign currency loan to an offshore entity in order to protect their foreign currency deposit against any further tightening or forced conversion into kina; or

- A business that is owed a foreign currency debt under an inter-company loan from its offshore parent entity might consider offsetting a dividend or management fee owed to its parent in lieu of repayment of the loan.

‘The penalties for breaching the foreign currency controls can be severe.’

In each of the above scenarios, the parties would need to agree to an appropriate exchange rate. They may even agree to an exchange rate that is equal to one of the six authorised foreign exchange dealers in PNG, or otherwise within the FX trading band imposed on the authorised dealers by the central bank in June 2014.

Breach

However, all of the above scenarios would be a breach of PNG’s Foreign Exchange Control Regulations, which prohibit the selling or exchanging of foreign currency (or transactions that have the effect of this) other than through the central bank or an authorised dealer. The words ‘or transactions that have the effect of this’ are key here.

‘Businesses that are able to ride out short term challenges such as this should be well placed.’

The penalties for breaching the foreign currency controls can be severe and include large fines, prison terms, and/or forfeiture of foreign currency or goods.

Businesses will continue to experience the negative impacts of a squeeze on the availability of foreign currency for the foreseeable future. However, Dentons, like most long established businesses in PNG, retains a positive outlook on PNG’s economy.

Businesses that are able to ride out short term challenges such as this should be well placed to benefit from the next significant growth phase in PNG’s economy.

Stephen Massa is the Managing Partner of Dentons’ Port Moresby office.

Speak Your Mind