The outlook is positive for the key commodities exports that will support Papua New Guinea’s resources sector in coming decades, including LNG, gold and copper. Business Advantage PNG speaks with the analysts to find out why.

Bullish commodity forecasts are good news for the PNG LNG project, seen here at Caution Bay. Credit: ExxonMobil PNG.

As a significant producer of liquefied natural gas (LNG) and gold, and with plans to expand its substantial copper resources, Papua New Guinea is well placed for the future.

LNG prices are likely to “remain higher than most people speculate” in the coming years due to a lack of new investments globally, Westpac’s Senior Economist Justin Smirk tells Business Advantage PNG.

In fact, Smirk says, the outlook is “more optimistic” and “less uncertain” than when the PNG LNG project commenced in 2014.

PNG’s proximity to Asia puts it in a particularly strong position. Asia received 261 million tonnes of LNG imports in 2023, 65 per cent of the world’s total, according to the International Group of Liquefied Natural Gas Importers.

While demand is falling in traditional markets that are moving away from carbon-based energy, such as Japan, South Korea and the European Union, independent commodities analyst David Lennox notes it is increasing in China, which requires “huge quantities” of LNG to keep the wheels of its economy operating.

“PNG is closer to the sources of demand that we’re now seeing. It’s a significant player for those suppliers and customers who are looking for a competitive edge in terms of the cost of shipping,” Lennox says.

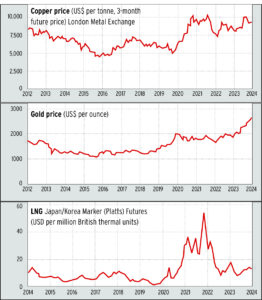

Gold, copper and LNG price charts

Gold in an unpredictable world

Meanwhile, the gold price has surged in 2024, breaking out from the roughly US$1,600 to US$2,000 per ounce (oz) that it traded at for most of 2020 to 2023 – already historical highs – to an all-time record of more than US$2,700/oz at time of writing.

Soni Kumari, Commodities Strategist at ANZ, tells Business Advantage PNG that the base price for gold has shifted and prices are unlikely to fall below US$2,000/oz in the foreseeable future.

The geopolitical instability that began with Russia’s invasion of Ukraine triggered “a shift in central bank positions, who want to increase more of their gold reserves,” she says.

United States treasury bills are no longer considered as safe as they once were, Kumari says, adding that “China and the BRICS countries are uniting together, because they see the risk that can be imposed if there is just one reserve currency.”

This fast-changing situation is likely to “support gold demand,” she says.

Kumari and Smirk both note that a rate-cut cycle in the United States (which began on 19 September 2024, when its Federal Reserve cut its target interest rate by half a point), and the likelihood of this weakening the US dollar, would also be supportive of gold.

Copper and tech innovation

Copper is of strong interest to PNG in the long-term, given the plans to develop the Wafi-Golpu and Frieda River projects, which are forecast between them to produce 336,000 tonnes of copper per year by 2036.

Indeed, the potential to increase Newmont Corporation’s exposure to copper was a “fundamental premise” behind its 2023 acquisition of Newcrest Mining, the previous co-owner of Wafi-Golpu. Newmont CEO Tom Palmer believes artificial intelligence and data centres are rapidly emerging as a new demand driver for copper, alongside the green energy transition.

This assessment is supported by figures from the International Energy Agency (IEA), which says that data centres consumed 460 terawatt hours in 2022, representing around 2 per cent of all global electricity usage. This could more than double by 2026, according to the IEA.

Copper prices have also been buffered by supply issues, with Kumari noting that the top three producers – Chile, Peru and the Democratic Republic of Congo, which together produce 46 per cent of the world’s copper – “are not very stable.”

Smirk forecasts that the lack of new investments in copper, overlaid with growth in demand, will see “an underlying upward trend” in the real copper price.

“I would argue that, if you find rich sources of copper to mine within PNG, they become very valuable in long term cycles,” he says. “I’m quite bullish on copper.”

This is a version of an article first published in the Business Advantage PNG Mining & Energy Special Edition 2024/25, which was published in October 2024.

Speak Your Mind