High debt and deficit levels are the reasons why ratings agency Standard & Poor’s (S&P) has kept its Papua New Guinea country rating at B+/B, with a negative outlook. S&P Director, Craig Michaels, tells Business Advantage PNG that higher commodity prices are the key to lifting the rating.

S&P Global Ratings’ Craig Michaels

Michaels, the Director of Sovereign and Public Finance Ratings, says the decision reflected the high levels of offshore debt and high government deficits.

‘These have been driven, directly or indirectly, by the large LNG project, and we thought those external and fiscal imbalances would unwind pretty quickly once the LNG project came on line,’ he told Business Advantage PNG.

‘But unfortunately, just as that happened, commodity prices globally fell very sharply.

‘So the revenues that were due to come on stream at that point have been coming in much more slowly and that’s why we have continued our negative outlook on PNG ratings.’

Forceful

Sovereign ratings are used as an indicator for setting a country’s base interest rate. They also have an effect on its ability to raise offshore financing, which the PNG government has been attempting.

PNG’s rating has been comparatively stable. S&P has maintained its B+/B rating for over five years, although it converted its outlook to negative in October 2015, when commodity prices began to weaken.

Michaels says the government has responded ‘forcefully’ to the revenue declines through savings decisions, and by targeting declining fiscal deficits to keep debt within its targets.

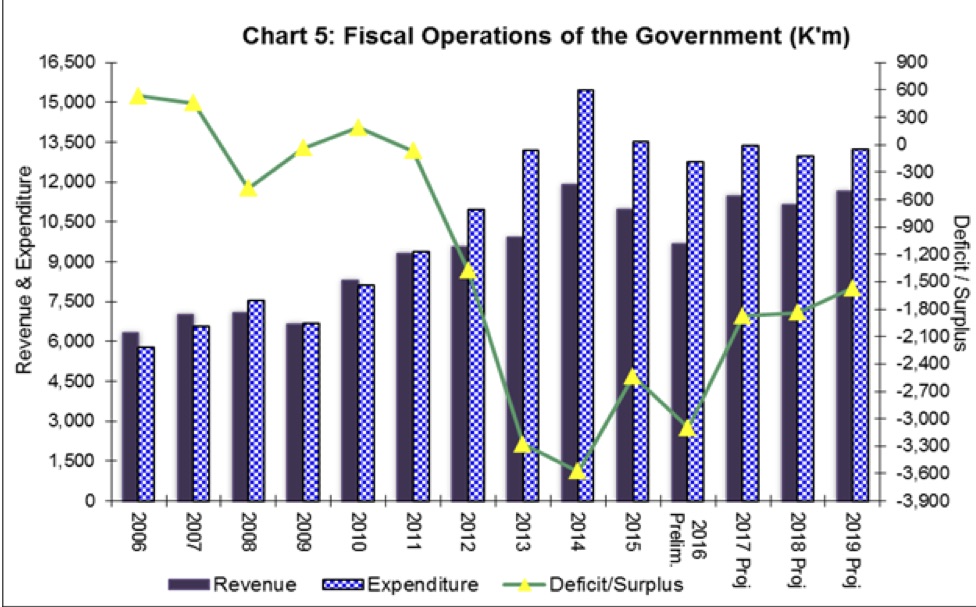

Overall spending between 2014-2016 fell by about 13 per cent over this period, with the result that the fiscal deficit narrowed to 4.4 per cent of GDP in 2016, from 6.9 per cent in 2013.

‘We project PNG’s general government net debt to remain comfortably below 30 per cent of GDP.’

‘Despite an election in mid-2017, we expect the deficit to narrow further this year to less than 3 per cent of GDP,’ he says.

‘On this basis, we project PNG’s general government net debt to remain comfortably below 30 per cent of GDP.’

Michaels warns, however, that if the government fails to continue to restrain spending adequately, or if growth in the nominal economy comes under even further downward pressure, net general government debt could rise above 30 per cent.

PNG government revenues, expenses and deficits/surpluses Source: Bank of PNG, 2017 Budget papers

Debt financing

Michaels believes domestic banks and pension funds have nearly reached their limits for lending to the government, and that the central bank is acting as lender-of-last-resort when government bond auctions are undersubscribed.

‘The limited demand for government debt has led to a sharp rise in yields on government paper in recent years, and the government’s interest burden has risen significantly as a result.’

‘Michael says one of the key challenges for PNG’s overall growth prospects is the high level of crime.’

Gross external financing needs are currently at 80-90 per cent of current account receipts, and likely to remain at that level as ‘it appears the government is very committed to keeping debt within its own debt limits’.

Michaels laments that, despite some recent improvements, there are gaps in economic and external data, as well as a lack of transparency in public-sector accounting.

Growth

Michael says one of the key challenges for PNG’s overall growth prospects is the high level of crime, ‘which we think is a major deterrent for investment outside the resources sector’.

‘S&P could return the rating outlook to ‘stable’ from ‘negative’ if we become convinced that the high level of external debt and the pretty sizeable fiscal deficits will continue to decline in a reasonably quick way.’

He expects growth to be 3 per cent in 2017, up slightly from 2.6 per cent in 2016.

‘The medium-term economic outlook hinges on whether further large foreign-financed projects—such as the Papua LNG project—go ahead.’

Upgrade

Michaels says S&P could return the rating outlook to ‘stable’ from ‘negative’ ‘if we become convinced that the high level of external debt and the pretty sizeable fiscal deficits will continue to decline in a reasonably quick way’.

‘And that will probably largely hinge on what happens with commodity prices.’

Speak Your Mind