Economists are forecasting a recession in PNG in 2020 as the country struggles to deal with the global crisis caused by the outbreak of the COVID-19 virus. The ratings agency Standard & Poor’s has also downgraded the country’s debt.

A report by ANZ Bank, Pacific Insight – PNG, predicts that the PNG economy will be in recession in 2020, contracting by 2.6 per cent. It says government expenditure will increase to ‘an all time high’ of K19.3 billion, while revenue will fall by K2.5 billion.

‘The PNG government will have a shortfall of K1 billion in petroleum taxes and dividends, which, in turn, is due to a collapse in oil prices.

‘We believe another K1.5 billion of projected overall tax revenue won’t be realised due to a lacklustre economy. The shutdown of the Porgera gold mine while the operator, Barrick Niugini, pursues a legal challenge to the government’s decision not to extend its Special Mining Lease, along with disruptions at the Kainantu gold mine due to landowner disputes, will impact revenue.

‘Expect more constraints to government spending over the medium term, with further implications for the country’s ambitious plans to expand its oil and gas sector.’

‘This means the budget deficit will blow out to K7.7 billion (8.6 per cent of GDP) this year.’

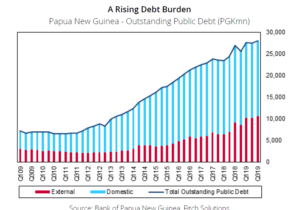

The ANZ report says the government is planning to fund the K7.7 billion budget deficit by borrowing from multilateral agencies and issuing debt in the domestic market, selling mainly to banks and super funds.

Recession around the corner

A report by Fitch Solutions’ Country Risk Research has said economic growth in PNG in 2020, will ‘come in at close to zero’.

The report says the biggest impact of the pandemic a slump in exports, triggered by a combination of supply-chain disruptions, weakening external demand and plunging commodity prices.

‘Aside from the shock to growth, this is also expected to put increased strain on public finances, with Treasurer Ian Ling-Stuckey recently warning that the government could lose up to K2 billion in revenues this year,’ the report says.

‘We believe more rescue spending may be required in the coming months.

‘With this in mind, we have raised our budget deficit forecast for 2020 from 4.7 per cent of GDP to 6.5 per cent, exacerbating an already challenging fiscal position.

‘The COVID-19 pandemic is expected to further increase the country’s vulnerability because of volatile global conditions.’

‘We expect more constraints to government spending over the medium term, with further implications for the country’s ambitious plans to expand its oil and gas sector.’

Debt downgrade

The ratings agency Standard & Poor’s (S&P) has lowered its long-term foreign and local currency sovereign credit ratings for PNG from B to B minus. But it has affirmed its B short-term rating on the country and has said that the outlook is stable.

S&P says ‘increasing debt levels and limited fiscal manoeuvrability’ leave PNG vulnerable to a volatile global backdrop. The COVID-19 pandemic is expected to further increase the country’s vulnerability because of volatile global conditions.’

The report says the sovereign ratings on PNG reflect ‘structural constraints inherent in a low-income economy, a dependence on the mining industry and weak institutions.’

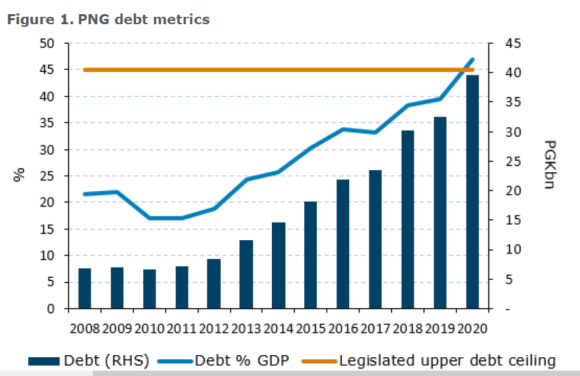

It adds that the public debt burden is increasing while fiscal (budgetary) pressures grow. It also points to a continuation of the foreign exchange shortages.

The S&P report predicts that real (after inflation) growth in PNG in 2020 will be minus 0.2 per cent.

It does sound some positive notes, however, saying the ‘weaker metrics’ are unlikely to lead to a sovereign default.

‘We expect multilateral and bilateral partner loans will step up to finance fiscal deficits, with net debt increasing to about 42 per cent of GDP in 2020.’

Speak Your Mind