Day 1 of the 2024 Business Advantage PNG Investment Conference featured top speakers from across the business sector, including Kumul Petroleum Holdings’ Wapu Sonk, Bank of Papua New Guinea Chairman David Toua and the IMF’s Sohrab Rafiq, who spoke of the positive impact of the central bank’s new approach to managing foreign exchange.

Kumul Petroleum’s Wapu Sonk. Credit: Stefan Daniljchenko/BAI

Jet fuel import facility to be online by 2025

Kumul Petroleum Holdings (KPHL) expects its new jet fuel import facility at Motukea Port to come into operation by the first quarter of 2025, KPHL Managing Director Wapu Sonk told the conference.

“We were targeting December this year, but it’s been pushed back because we had to find a solution on how to work within an operating wharf area,” he said.

The facility will have four-to-six weeks’ worth of storage capacity, enough to ease shortages of jet fuel and “remove the need for Puma’s facility next door at Napa Napa,” he continued.

KPHL is one of several businesses reportedly developing alternative fuel-import facilities to those run by Puma Energy in the hope of ending chronic fuel supply shortages in PNG.

Papua LNG delayed

Sonk also provided an update about the Papua LNG project, saying that a final investment decision had been pushed back to the fourth quarter of 2025 or the first quarter of 2026.

He singled out engineering, procurement and construction (EPC) contractors for the delay, saying the costs they had presented were 40 to 50 per cent above what was expected. As a result, he said, the contract process had re-opened and other participants were being invited to bid.

“There is still a project, Total is still the operator. They are working to bring costs down,” Sonk told the conference.

Calling the delay “a blessing in disguise,” he said it meant first production would be pushed back to 2028 to 2030, when LNG prices are expected to pick up again.

“We are in a strong position to get a better price, which helps the economics of the project. In hindsight, [the delay will be] really good for our profit margin.”

Central bank acting “carefully”

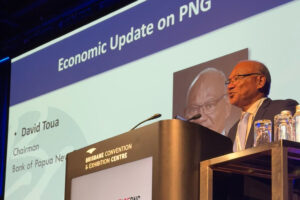

The Bank of PNG’s David Toua

Meanwhile, Bank of Papua New Guinea Chairman David Toua refuted recent media coverage around how the bank is managing the kina’s devaluation.

“We’re engaged in a careful and managed process to regularly and frequently assess the needs for adjustments for our currency to manage the competing needs of all businesses in our economy,” Toua told the conference.

“We do this prudently and without making any irrational action.”

In the past year, Toua said, the bank has introduced measures to remove liquidity from the market and make monetary policy “a more effective tool” for stabilising prices.

“We acted to tighten liquidity in two steps, namely, two increases in what is for now, our most effective instrument, the cash reserve requirement. That has resulted in the return of our government T bill rates to those seen prior to Covid. In time, we expect to see term deposit rates increase to more normal levels, with more competition helping to put forward pressure on rates.”

Just last week in Lae, he further noted, the board agreed to raise the kina facility rate to 3 per cent.

“It’s our most important signaling tool, and demonstrates that we’re comfortable with and want a higher interest rate structure, which is normal for PNG.”

IMF country head: Crawl-like exchange rate mechanism benefitting wider economy

Sohrab Rafiq, International Monetary Fund (IMF) Country Manager for PNG, also emphasised the benefits of the Bank of Papua New Guinea’s new ‘crawl-like’ exchange rate policy in a wide-ranging presentation to the 2024 PNG Investment Conference.

“The key point [under the crawl-like mechanism] is that the exchange rate will be more reflective of market conditions… [and] you won’t have these big sudden jumps in the exchange rate like you would under a fully floating exchange rate system,” he told the conference.

“The advantage of this system is that by having an exchange rate that’s more reflective of its market conditions, it’ll help protect the country’s foreign exchange reserves.”

Looking back on the previous policy, Rafiq said an overvalued kina is “not just bad economics, it’s also unfair from an equity perspective as well.”

“If you can make the country attractive enough and if you can reward investors sufficiently enough through the pricing mechanism and the exchange rate, then hopefully that will generate investment that will push up GDP growth, that will encourage job growth, push up household incomes and essentially deal with the with the cost-of-living crisis.”

Speak Your Mind