Papua New Guinea’s mandated debt levels are fiercely debated but, according to David James, Managing Editor of Business Advantage PNG, most countries are far less prudent. Could concentrating on the national debt distract from another problem—the lack of an international market for the country’s financial assets?

Papua New Guinea’s government debt-to-GDP ratio. Source: Tradingeconomics, BAPNG

PNG’s government debt is between 30-35 per cent of GDP, hovering around the mandated level of 32.6 per cent set under the Fiscal Responsibility Act. Most countries in the world, especially developed economies, would love to have such low debt.

Worst placed is probably Japan, with debt over 250 per cent of GDP, but China is similarly burdened when its shadow banking is taken into account, according to Philip Lowe, Governor of the Reserve Bank of Australia.

US public debt is about 107 per cent of GDP, which is similar to the average for most European countries. Australia’s government debt-to-GDP ratio is low at about 42 per cent of GDP, but its household debt has soared to over 100 per cent of GDP.

It is not suggested that there was anything wrong with PNG’s Fiscal Responsibility Act. On the contrary, it was something of a master stroke.

It has probably stopped PNG governments from making two mistakes that have bedevilled developing nations for five decades, resulting in crises like the Latin American debt crisis in the 1980s, the Asian financial crisis of the 1990s, and the Global Financial Crisis of 2007-08.

It limited the prospect of government officials borrowing money that is then wasted (or stolen, as happened in Latin America in the 1980s).

The Act also reduced the possibility of PNG borrowing in US dollars (although there are currently proposals for a sovereign bond in euros).

‘It is as if a giant roulette wheel is sitting atop the world, threatening to crash down and destroy the entire banking system.’

For the last 30 years, in Asia, Africa and South America countries have found that when they borrow in US dollars their local currency can collapse against the greenback.

When that happens, their debt becomes unsustainable and they are forced to sell off government assets to pay creditors, causing lasting damage to their economies.

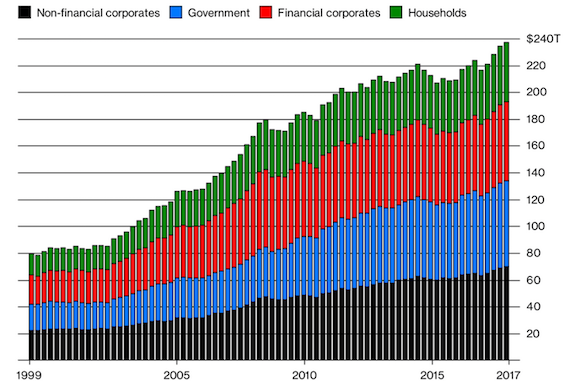

Global debt since 2000. Source: Bloomberg

Global debt

The global financial system has not recovered from the GFC a decade ago. Global debt is a staggering 253 per cent of GDP which is, quite simply, un-payable.

It means that either interest rates will continue at close to zero—the can will be kicked down the street—or, as has happened for thousands of years, there will be debt forgiveness. The most likely first candidate is Japan, whose debt is almost all owed internally.

Worse, when one looks at the US$542 trillion stock of derivatives (financial gambling ‘derived’ from shares, interest rates, currencies and bonds), one has to conclude that the global financial system is lacking basic sense.

It is as if a giant roulette wheel is sitting atop the world, threatening to crash down and destroy the entire banking system at any moment.

‘The focus on PNG’s low debt has distracted analysts from the real issue.’

PNG, by contrast, has—comparatively—very low government debt, and very low household debt.

It has no derivatives and no secondary bond market, which means that all government debt has to be held to maturity.

PNG is also one of the few places in the world, because of its large informal economy and mostly unbanked population, that might be able to survive relatively unscathed if there is a repeat of the GFC, which in 2008 nearly destroyed all world banking.

Ratings agencies

Exactly why anyone would listen to ratings agencies is far from clear when one considers that their false, paid-for assessments were critical in the GFC. Memories are short.

It is possible that the agencies’ and other institutions’ focus on PNG’s debt has distracted analysts from another issue, which is the lack of trading (liquidity) in PNG financial assets, mainly because they are not readily available to overseas investors.

Interest rates on PNG Treasury bills, which are over 8 per cent, look outstanding in the current environment of near-zero interest rates, even taking into account the associated currency risk.

These government debt offerings also do not expose the PNG government to any currency risk because they are denominated in kina.

There is good reason to improve access to overseas investors, especially when it would improve the inflow of badly needed foreign exchange.

Some work is being done on making PNG government debt electronically available globally (at the moment it is only paper-based).

This is a positive move, given that PNG’s domestic banks are running into their limits on buying government paper. The only downside is it may lead to greater currency volatility.

Most of all, it is time to ditch the idea that the PNG government is fiscally irresponsible.

‘Compared with whom?’ one might ask.

David James is Managing Editor at Business Advantage PNG, and was a former senior writer and columnist at Business Review Weekly for 25 years.

Speak Your Mind